UNITED STATES SECURITIES AND EXCHANGE COMMISSIONWashington, D.C. 20549 SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of theSecurities Exchange Act of 1934Filed by the Registrant ¨

Filed by a Party other than the Registrant

| | Filed by the Registrant

☒ | |

| | Filed by a Party other than the Registrant

☐ | |

| | Check the appropriate box: | |

| | ☐

Preliminary Proxy Statement | |

| | ☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| | ☒

Definitive Proxy Statement | |

| | ☐

Definitive Additional Materials | |

| | ☐

Soliciting Material Pursuant to §240.14a-12 | |

¨Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

CONSOLIDATED WATER CO. LTD.

(Name of Registrant as Specified in Its Charter) Payment of Filing Fee (Check the appropriate box):

| | ¨☐

Fee paid previously with preliminary materials. | |

| | ☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

CONSOLIDATED WATER CO. LTD.

Regatta Office Park, Windward Three, 4th Floor, West Bay RoadP.O. Box 1114Grand Cayman, KY1-1102Cayman Islands

Notice of Annual General Meeting of Shareholdersto be held on Monday,Tuesday, May 23, 202228, 2024

Notice is hereby given that the Annual General Meeting of Shareholders of Consolidated Water Co. Ltd. (the “Company”) will be held at 4:00 p.m., Eastern Daylight Time (3:the Grand Cayman Marriott Resort, 389 West Bay Road, Seven Mile Beach, Grand Cayman, Cayman Islands, at 3:00 p.m. Cayman Islands time)time (4:00 p.m. Eastern Daylight Time), on Monday,Tuesday, May 23, 2022. The Annual General Meeting will be a “hybrid” meeting of shareholders. Shareholders will be able to attend the Annual General Meeting as well as vote during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/cwco2022 or by attending the meeting in person at the Company’s headquarters at Regatta Office Park, Windward Three, 4th Floor, West Bay Road, Grand Cayman, KY1-1102, Cayman Islands. In the interest of health and safety, we strongly encourage shareholders desiring to attend the meeting to do so via the meeting website. Upon logging into the meeting website for the live webcast, a telephone number will be displayed for shareholders to utilize to pose questions along with a question box to submit questions in writing.28, 2024. Shareholders will need to have the 16-digit control number included on their Notice of Internet Availability, their proxy card or the instructions that accompanied their proxy materials to be admitted personally or virtually to the Annual General Meeting or to access the phone number for questions. The phone number for questions is provided solely for the convenience of asking questions during the meeting. Shareholders will not be able to vote their shares over the phone during the meeting.Meeting.

The Annual General Meeting will be held for the purpose of considering and acting upon the following matters:

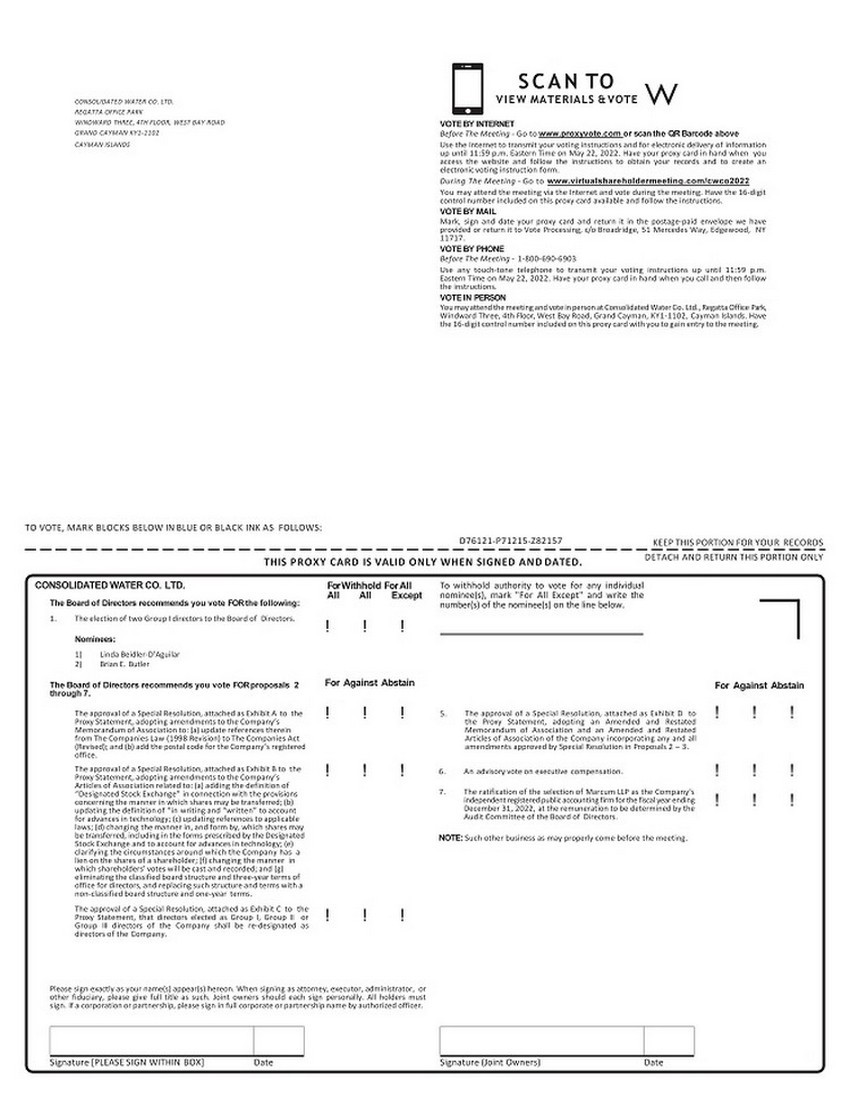

| 1. | The election of two Group I directors to the Board of Directors; |

| 2. | The approval of a Special Resolution, attached as Exhibit A, adopting amendments to the Company’s Memorandum of Association to: (a) update references therein from The Companies Law (1998 Revision) to The Companies Act (Revised); and (b) add the postal code for the Company’s registered office; |

| 3. | The approval of a Special Resolution, attached as Exhibit B, adopting amendments to the Company’s Amended and Restated Articles of Association related to: (a) adding the definition of “Designated Stock Exchange” in connection with the provisions concerning the manner in which shares may be transferred; (b) updating the definition of “in writing” and “written” to account for advances in technology; (c) updating references to applicable laws; (d) changing the manner in, and form by, which shares may be transferred, including in the forms prescribed by the Designated Stock Exchange and to account for advances in technology; (e) clarifying the circumstances around which the Company has a lien on the shares of a shareholder; (f) changing the manner in which shareholders’ votes will be cast and recorded; and (g) eliminating the classified board structure and three-year terms of office for directors, and replacing such structure and terms with a non-classified board structure and one-year terms; |

| 4. | The approval of a Special Resolution, attached as Exhibit C, that directors elected as Group I, Group II or Group III directors of the Company shall be re-designated as directors of the Company; |

| 5. | The approval of a Special Resolution, attached as Exhibit D, adopting an Amended and Restated Memorandum of Association and an Amended and Restated Articles of Association of the Company incorporating any and all amendments approved by Special Resolution in Proposals 2 – 3; |

| 6. | The advisory vote on executive compensation; |

| 7. | The ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022, at the remuneration to be determined by the Audit Committee of the Board of Directors; and |

| 8. | Such other business as may properly come before the meeting. |

The election of eight directors to the Board of Directors;

2.

The advisory vote on executive compensation;

3.

The ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024, at the remuneration to be determined by the Audit Committee of the Board of Directors; and

4.

Such other business as may properly come before the meeting.

Admittance to the meeting will be limited to shareholders. The Board of Directors has fixed the close of business on March 24, 202228, 2024 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and any postponement or adjournment thereof. Accordingly, only shareholders of record at the close of business on that date will be entitled to vote at the meeting. EACH SHAREHOLDER IS URGED TO SUBMIT A PROXY AS SOON AS POSSIBLE VIA THE INTERNET, TELEPHONE OR MAIL. ANY PROXY (AND ANY POWER OF ATTORNEY OR OTHER AUTHORITY UNDER WHICH IT IS SIGNED, OR A NOTARIZED COPY OF SUCH AUTHORITY) MUST BE DEPOSITED BY MAIL AT THE FOLLOWING ADDRESS: VOTE PROCESSING, C/O BROADRIDGE, 51 MERCEDES WAY, EDGEWOOD, NY 11717 OR ELECTRONICALLY AT WWW.PROXYVOTE.COM AT LEAST 24 HOURS BEFORE THE MEETING IN ORDER TO BE VOTED AT THE MEETING. SHAREHOLDERS WHO EXECUTE A PROXY MAY ATTEND THE MEETING; HOWEVER, ATTENDANCE AT THE MEETING WILL AUTOMATICALLY REVOKE A SHAREHOLDER’S PREVIOUSLY SUBMITTED PROXY. THEREFORE, A SHAREHOLDER WHO ATTENDS THE MEETING WILL NEED TO VOTE HIS, HER OR ITS SHARES AT THE MEETING (EITHER IN-PERSON OR VIRTUALLY ON THE MEETING WEBSITE) IN ORDER FOR HIS, HER OR ITS SHARES TO BE COUNTED. IN THE CASE OF JOINT HOLDERS, THE VOTE OF THE SENIOR HOLDER WHO TENDERS A VOTE, WHETHER DURING THE MEETINGIN PERSON OR BY PROXY, SHALL BE ACCEPTED TO THE EXCLUSION OF THE VOTES OF THE OTHER JOINT HOLDERS, AND FOR THIS PURPOSE SENIORITY SHALL BE DETERMINED BY THE ORDER IN WHICH THE NAMES OF THE HOLDERS STAND IN THE REGISTER. By Order of the Board of Directors,

Wilmer F. PergandeChairman of the BoardApril 13, 2022Enclosures

On behalf of the Board of Directors, it is our pleasure to invite you to the

20222024 Annual General Meeting of Shareholders of Consolidated Water Co. Ltd. to be held at

4:00 p.m., Eastern Daylight Time (3:the Grand Cayman Marriott Resort, 389 West Bay Road, Seven Mile Beach, Grand Cayman, Cayman Islands, at 3:00 p.m. Cayman Islands

time)time (4:00 p.m. Eastern Daylight Time), on

Monday,Tuesday, May

23, 2022. As COVID-19 continues to impact all aspects of our lives, we have a heightened awareness of and appreciation for our network of shareholders, directors, employees and service providers that may be affected. After careful consideration, we again have decided to hold a “hybrid” shareholder meeting, meaning that shareholders will be able to attend the meeting via the Internet by following the instructions set forth in the accompanying materials or in person in Grand Cayman, Cayman Islands. In the interest of health and safety, we strongly encourage shareholders desiring to attend the meeting to do so via the Internet. We feel this option is in the best interests for our shareholders’ health in light of the latest information and advice regarding the spread of COVID-19.This28, 2024.

These past several years have presented unprecedented challenges on a global scale.

We continue to mourn the losses COVID-19 has inflicted on so many individuals and families across the world. We are appreciative of the opportunities we have had to continue to serve our customers

while they metafter overcoming the challenges they

faced and will continue our contributions to help those in our service areas.faced. Throughout the year, the Board of Directors and executive management collaborated closely to ensure the company met its commitments to a broad range of stakeholders, including our employees, customers, the communities we operate in, suppliers, and of course our shareholders.

Amidst the challenges, this past fiscal year offered another year for quality financial performance, and we delivered positive results for our shareholders, including returning approximately

$5.2$5.5 million to shareholders in the form of

dividends.dividends and increasing the stock price by over 100%. We celebrate these successes as we continue to pursue our business development efforts and look forward to more opportunities ahead as we remain committed to the long-term interests of shareholders.

Our directors represent a wide range of backgrounds and expertise, with one director identifying as female and three directors identifying as “two or more races or ethnicities” under The

NasdaqNASDAQ Stock Market’s

new diversity rules, representing

over 50% of the non-executive members of the

Board.Board of Directors. We believe our diversity of backgrounds, experiences, perspectives, and skills contributes to the

board’sBoard of Director’s effectiveness in managing risk and providing guidance that positions the Company for long-term success. Of our

nineeight directors,

eightseven are independent,

which includesincluding our Chairman, and

all committee members, other thanthe sole executive director is Frederick W. McTaggart, who is the Chair of our

recently formed Environmental

and Social

and Governance Committee.

This Proxy Statement contains details of the business to be conducted during the Annual General Meeting and describes our corporate governance policies and practices. We continue to be considered a smaller reporting

company.company for this year. As such, we have elected to adopt the scaled disclosure requirements afforded to smaller reporting companies, while still communicating material information and our perspectives to our shareholders. In addition to communicating information and our perspectives, we also believe in the value of listening to our shareholders. Shareholder feedback also helps us prioritize our efforts and enhance our transparency.

Whether or not you participate in the Annual General Meeting, it is important that your shares be represented and voted during the meeting. We urge you to promptly vote and submit your proxy (1) via the Internet, (2) by phone or (3) if you received your proxy materials, by mail, by signing, dating, and returning the enclosed proxy card or voting instruction form in the envelope provided for your convenience.

As we look ahead, we remain excited about the opportunities we have in terms of our business, shareholder value creation, and contributing to the markets and parties we serve. Thank you for the trust you place in us and the opportunity to serve you and our company as directors. On behalf of all directors, I extend our gratitude for your support and request that you vote in the affirmative for the proposals to be considered at the Annual General Meeting.

Wilmer F. PergandeChairman of the Board of Directors

| | Note About Forward-Looking Statements

This Proxy Statement includes estimates, projections, statements relating to our business plans, objectives, and expected operating results that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. We describe risks and uncertainties that could cause actual results and events to differ materially in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our Forms 10-K and 10-Q. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise, unless required to do so by law. | | |

CONSOLIDATED WATER CO. LTD.

Annual General Meeting of ShareholdersMonday,Tuesday, May 23, 202228, 2024

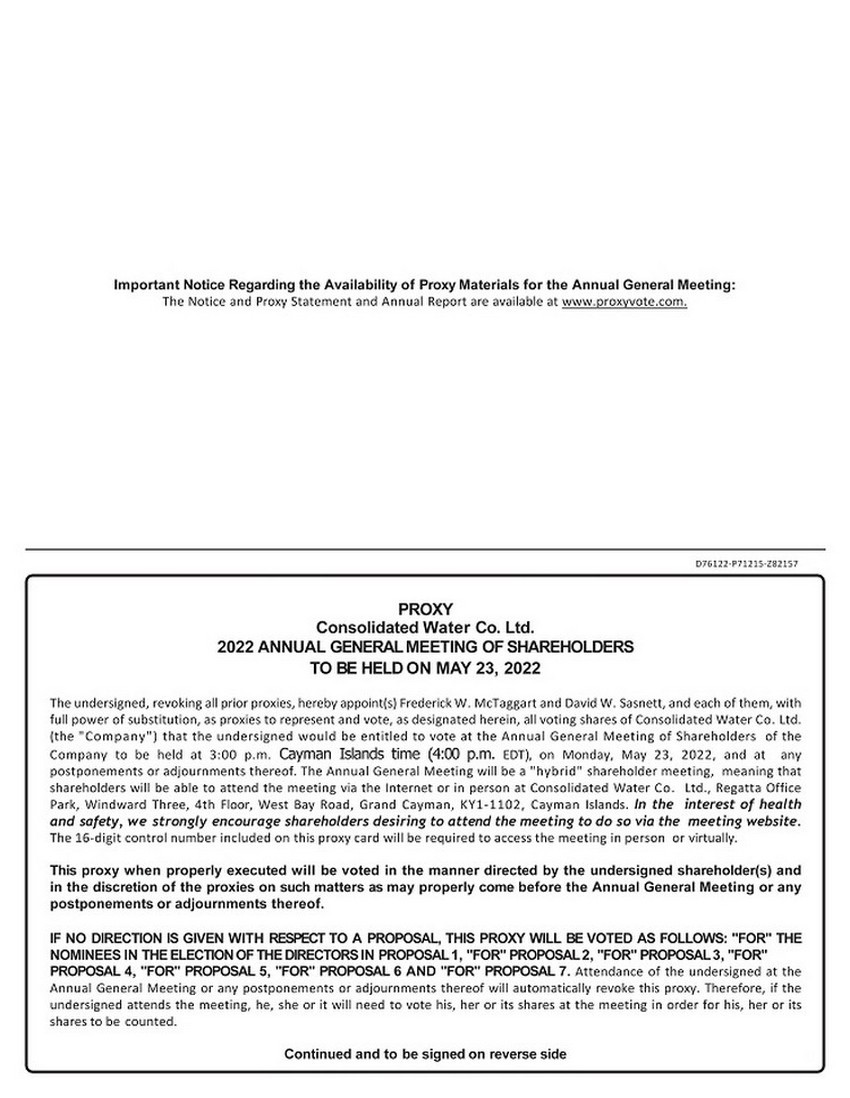

This Proxy Statement has been prepared and is distributed and made available by the board of directors (the “Board of Directors”) of Consolidated Water Co. Ltd. (the “Company”) in connection with the solicitation of proxies for the Annual General Meeting of Shareholders of the Company (the “Annual General Meeting”) to be held at

4:00 p.m., Eastern Daylight Time (3:the Grand Cayman Marriott Resort, 389 West Bay Road, Seven Mile Beach, Grand Cayman, Cayman Islands, at 3:00 p.m. Cayman Islands

time)time (4:00 p.m. Eastern Daylight Time), on

Monday,Tuesday, May

23, 2022,28, 2024, and any adjournment or postponement thereof for the purpose set forth in the accompanying Notice of Annual General Meeting of Shareholders.

The Annual General Meeting will be a “hybrid” meeting of shareholders, meaning shareholders will be able to attend the Annual General Meeting as well as vote during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/cwco2022 or attend the meeting in person at the Company’s headquarters at Regatta Office Park, Windward Three, 4th Floor, West Bay Road, Grand Cayman, KY1-1102, Cayman Islands. Upon logging into the meeting website for the live webcast, a telephone number will be displayed for shareholders to utilize to pose questions along with a question box to submit questions in writing. Shareholders will need to have the 16-digit control number included on their Notice of Internet Availability, their proxy card or the instructions that

accompaniedaccompany their proxy materials to be admitted

personally or virtually to the Annual General

Meeting or to access the phone number for questions. The phone number for questions is provided solely for the convenience of asking questions during the meeting. Although shareholders have the option to attend the meeting in person, in the interest of health and safety, we strongly encourage shareholders desiring to attend the meeting to do so via the Internet.Meeting.

This Proxy Statement and the accompanying form of proxy will be distributed to shareholders and will be made available for viewing, downloading and printing by shareholders at www.proxyvote.com, on or about April 13, 2022.18, 2024. The Company will bear the cost of the solicitation of proxies. Only holders of record of the Company’s Ordinary Shares, par value CI$0.50 per share (the “Ordinary Shares”), and the Company’s Redeemable Preference Shares, par value CI$0.50 per share (the “Redeemable Preference Shares”), on the books of the Company at the close of business on March 24, 2022,28, 2024, are entitled to vote at the Annual General Meeting. On that date, 15,267,10415,828,929 Ordinary Shares and 28,63544,025 Redeemable Preference Shares were issued and outstanding. Our Ordinary Shares and Redeemable Preference Shares are referred to as “common stock” and “redeemable preferred stock,” respectively, in our consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States of America. All matters that come before this Annual General Meeting will be decided by a vote that will be demanded in each case by Frederick W. McTaggart or David W. Sasnett, the persons who are appointed proxies in the proxy card which accompanies this Proxy Statement. Each shareholder of record is entitled to one vote for each Ordinary Share or Redeemable Preference Share (collectively, the “Shares”) on all matters that come before the Annual General Meeting. The holders of 331∕1∕3% of the issued and outstanding Shares, present at the meeting (virtually or in person)person or represented by proxy, will constitute a quorum for the transaction of business at the Annual General Meeting. For Proposal 1, the election of

twoeight directors, each nominee shall be elected as a director if the number of Shares cast “for” such nominee’s election exceeds the number of Shares “withheld” with respect to such nominee’s election. The

Amended and Restated Articles of Association (the “Articles”) require approval of holders of at least 75% of the Shares cast to approve each Special Resolution submitted under Proposals 2 – 5 (collectively, the “Special Resolutions”). The approval of holders of at least a majority of the Shares cast is required for: (i) Proposal

6,2, the advisory vote on executive compensation; and (ii) Proposal

7,3, the ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31,

2022.2024.

Proposal 1 (the election of

twoeight directors)

, Proposal 3 (the Special Resolution amending the Articles) and Proposal

62 (the advisory vote on executive compensation) are considered “non-routine” matters. Proposal

2 (the Special Resolution amending the Company’s Memorandum of Association), Proposal 4 (the Special Resolution that directors elected as Group I, Group II or Group III directors of the Company shall be re-designated as directors of the Company) and Proposal 5 (the Special Resolution adopting an Amended and Restated Memorandum of Association and an Amended and Restated Articles of Association incorporating any and all amendments approved by Special Resolution in Proposals 2 and 3) and Proposal 73 (the ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31,

2022) are2024) is considered a “routine” matter. Banks, brokers, or other nominees (“Brokers”) who hold shares on behalf of beneficial shareholders have discretion to vote such shares with respect to “routine” matters without receiving voting instructions from the beneficial holders of the shares. However, Brokers who hold shares on behalf of beneficial shareholders do not have discretion to vote such shares with respect to “non-routine” matters if they do not receive voting instructions from the beneficial holders of the shares. If no instruction is given to Brokers with respect to “non-routine” matters, a “broker non-vote” is recorded for each such uninstructed share. Abstentions and “broker non-votes” are not treated as votes cast and, therefore, will not affect the outcome of the vote.

Shares represented by a properly executed proxy must be received not later than 24 hours before the scheduled time of the meeting and, if received in time to permit its use at the meeting or any postponement or adjournment thereof, will be voted in accordance with the instructions indicated therein. If no instructions are

indicated, the Shares represented by the proxy will be voted (i) “for all” in the election of the nominees for director; (ii) “for” the approval of each of the Special Resolutions; (iii) “for” the approval of executive compensation; and (iv)(iii) “for” the ratification of the selection of Marcum LLP as the Company’s independent registered public accounting firm. A shareholder of record who has given a proxy may revoke it at any time before it is voted at the meeting by giving written notice of such revocation to the office of the Secretary of the Company, or by executing and delivering to the Company not later than 24 hours before the scheduled time of the meeting a proxy bearing a later date. A proxy will be revoked automatically if a shareholder attends the meeting.

Shareholders may, by electronic means via the Internet, by telephone or by mail, appoint a proxy to vote Shares before the meeting as more fully described below:

| · | By Internet: Go to www.proxyvote.com and follow the instructions. Shareholders should have their proxy card available when accessing the site. |

| · | By Telephone: Call 1-800-690-6903 and follow the voice prompts (have your proxy card available). |

| · | By Mail: If shareholders have received a proxy card, shareholders should mark their vote, sign their name exactly as it appears on the proxy card, date the card and return it in the envelope provided. |

•

By Internet: Go to www.proxyvote.com and follow the instructions. Shareholders should have their proxy card available when accessing the site.

•

By Telephone: Call 1-800-690-6903 and follow the voice prompts (have your proxy card available).

•

By Mail: If shareholders have received a proxy card, shareholders should mark their vote, sign their name exactly as it appears on the proxy card, date the card and return it in the envelope provided.

Shareholders that would like to request a physical copy of the material(s) for this and/or future shareholder meetings, may (1) visit

www.ProxyVote.com,www.proxyvote.com, (2) call 1-800-579-1639 or (3) send an email to sendmaterial@proxyvote.com. If sending an email, shareholders must include the 16-digit control number included on their Notice of Internet Availability, their proxy card or the instructions that accompanied their proxy

materials to be admitted personally or virtually to the Annual General Meeting or to access the phone number for questions.materials. Unless requested, you will not otherwise receive a paper or email copy.

Unless otherwise indicated herein, all references to “$” are to United States dollars and all references to “CI$” are to Cayman Island dollars.

[The remainder of this page is intentionally left blank.]

Election of Group I Directors The shareholders of the Company will vote on the election of

two Group Ieight directors at the Annual General Meeting. Each nominee listed below has consented to being named a nominee in this Proxy Statement and has agreed to serve as a director if elected at the Annual General Meeting. If, prior to the Annual General Meeting, a nominee should become unavailable to serve, the proxies in such nominee’s favor will be void. The Board of Directors knows of no reason to anticipate that this will occur.

In accordance with the Articles and corporate governance as in effect prior to the possible approval of the Special Resolutions to be considered under Proposals 3 and 4, the Board of Directors is divided into three groups, designated Group I, Group II and Group III. At the 2022 Annual General Meeting, shareholders

All eight directors will

vote on the election of the Group I directors. If the Special Resolutions to be considered under Proposals 3 and 4 are approved, then (a) the Board of Directors will no longer be classified into three groups, (b) the current terms of each director will expire as of the 2023 Annual General Meeting, and (c) thereafter, each director will be eligible for reelection annually. If the Special Resolutions to be considered under Proposals 3 and 4 are not approved, then (x) the Board of Directors will continue to be classified into three groups, (y), directors in Group II, Group III and Group I will be eligiblestand for reelection at the

Company’s2024 Annual General

Meetings in 2023, 2024 and 2025, respectively, and (z) each group, upon election, will serve until the third succeeding Annual General Meeting.

The affirmative vote of the holders of a majority of the Shares cast at the Annual General Meeting is required to elect each director. Abstentions and “broker non-votes” are not treated as votes cast and, therefore, will not affect the outcome of the vote. Unless a shareholder specifies otherwise on the accompanying proxy, its shares will be voted “FOR ALL” the Group I nominees listed below.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR ALL” IN THE ELECTION OF THE NOMINEES LISTED BELOW.Information Regarding Group I Directors

Linda Beidler-D’Aguilar, age 59,61, has been a director of our Company since November 2018. Ms. Beidler-D’Aguilar is an attorney andrecently retired from the active practice of law; she has lived and worked in The Bahamas since 1991. SinceFrom July 2015 to April 2023, she has beenwas a partner and head of the financial services practice at Glinton Sweeting O’Brien, a full-service boutique law firm located in Nassau, Bahamas, which specializes in financial services, corporate advisory services, securitization, real estate and resort development, and commercial litigation. From January 2005 to July 2015, Ms. Beidler-D’Aguilar was a partner at Graham Thompson, a law firm located in The Bahamas and Turks & Caicos specializing in trust and estate planning, commercial matters, civil litigation, family law, securitization, employment and immigration matters. Prior to joining Graham Thompson, Ms. Beidler-D’Aguilar worked briefly at another local law firm, before which she served as Vice President — Legal & Trademark, overseeing global intellectual property and domestic legal matters at Bacardi & Company Limited for almost nine years. Previously she was employed by two major trust companies in The Bahamas. Before moving to The Bahamas, Ms. Beidler-D’Aguilar practiced law in the United States. Upon her retirement, Ms. Beidler-D’Aguilar was given a Lifetime Achievement Award by the Bahamas Financial Services Board in recognition of her many years of dedicated support of the financial services industry in The Bahamas, including legislative drafting, public speaking and authorship of numerous articles for publication around the world.

Ms. Beidler-D’Aguilar was selected to serve as a member of our Board of Directors because of her nearly 30 years of experience as an attorney, her legal, business and financial knowledge acquired during that period and her knowledge of, and business contacts in, the Caribbean.

Brian E. Butler, age 72,74, has been a director of our Company since 1983. Mr. Butler, a full-time resident of the Cayman Islands, has since 1977 directed a consortium of property development companies presented under the Butler name specializing in luxury resort projects in the Cayman Islands, the Turks and Caicos Islands, and British Columbia, Canada. Mr. Butler was selected to serve as a member of our Board of Directors because of his

nearlyover 50 years of experience as a property developer (over

4045 of those years in the Caribbean), his business and financial knowledge acquired during that period and his knowledge of, and business contacts in, the Cayman Islands.

Information Regarding Group II Directors — For Informational Purposes — Not to Be Elected at the 2022 Annual General Meeting

Carson K. Ebanks, age 66,68, became the Cayman Islands government-nominated director of our Company in May 2001. Mr. Ebanks was the Director of Planning for the Cayman Islands from 1991 to 1997. He served the Cayman Islands Government as a Chief Officer beginning in 1997, and, when he retired in November 2011, he was Chief Officer for the Ministry of Finance, Tourism and Development. Mr. Ebanks is a Justice of the Peace, a Fellow of the Royal Geographic Society and a member of the Most Excellent Order of the British Empire. He holds a Bachelor of Environmental Studies (Hons. Urban and Regional Planning — Peace and Conflict Studies Minor) from the University of Waterloo and a Master of Arts — Planning in Community and Regional Planning from the University of British Columbia. He is a trustee of the National Gallery of the Cayman Islands and is the Secretary General of the Cayman Islands Olympic Committee. Mr. Ebanks is also the President of the Cayman Islands National Karate-Do Association. Mr. Ebanks has served on the Boards

of the Trustee of Cayman Islands National Museum, the Cayman Islands Airports Authority, the Cayman Islands Port Authority, Cayman Islands Turtle Farm, Cayman Islands Airways, the Cayman Islands Civil Service Co-operative Credit Union, the Housing Development Corporation, the Water Authority — Cayman and the National Roads Authority.

Mr. Ebanks, who was nominated to serve on our Board of Directors by the Cayman Islands government, was selected to serve as a member of our Board of Directors because of his knowledge of government affairs, his contacts within the Cayman Islands government and his experience in the water industry.

Richard L. Finlay, age 63, has served as a director of our Company since 1995. Mr. Finlay is an attorney and has practiced law in the Cayman Islands since 1992. From 2003, he was managing partner of Conyers Dill & Pearman, Cayman. He retired from practice in 2015 and currently acts as a consultant. Mr. Finlay served as Director of Legal Studies of the Cayman Islands Government from 1989 to 1992. From 1983 to 1989, Mr. Finlay was a partner with a Canadian law firm located in Regina, Canada. Mr. Finlay has served as the Cayman Islands’ representative to the International Company and Commercial Law Review and is a former editor of the Cayman Islands Law Bulletin. Mr. Finlay has been named a Board Leadership Fellow by the National Association of Corporate Directors since 2019.

Mr. Finlay was selected to serve as a member of our Board of Directors because of his knowledge of our Company and experience as a corporate lawyer practicing in the Cayman Islands and abroad.

Clarence B. Flowers, Jr., age 66,68, has been a director of our Company since 1991. Mr. Flowers is, and has been since 1985, the principal of Orchid Development Company, a real estate developer in the Cayman Islands. Mr. Flowers also serves as a director of C.L. Flowers & Sons, which is the largest manufacturer of wall systems in the Cayman Islands, and Cayman National Bank, a retail bank. Mr. Flowers was selected to serve as a member of our Board of Directors because of his more than 40 years of experience in the construction industry as a real estate developer in the Cayman Islands.

Frederick W. McTaggart, age 59,61, has been a director of our Company since 1998, the Company’s President since October 2000 and its Chief Executive Officer since January 1, 2004. Mr. McTaggart served as Chief Financial Officer of the Company from February 2001 to January 1, 2004. From April 1994 to October 2000, Mr. McTaggart was the Managing Director of the Water Authority — Cayman, the government-owned water utility serving certain areas of the Cayman Islands. From March 1987 to April 1994, he held the positions of Deputy Director and Operations Engineer with the Water Authority — Cayman. He received his B.S. degree in Building Construction from the Georgia Institute of Technology in 1985. Mr. McTaggart was selected to serve as a member of our Board of Directors because of his

extensive technical and managerial experience in the water industry, and his

knowledge and managerial experience

as the principal executive officer of the Water Authority — Cayman.within both public and private sector water utilities. Information Regarding Group III Directors — For Informational Purposes — Not to Be Elected at the 2022 Annual General Meeting

Wilmer F. Pergande, age 82,84, has been a director of our Company since 1978 and Chairman since 2009. He has more than 55 years of management, sales, manufacturing and engineering experience in the desalination industry.and chemical processing industries. Mr. Pergande is the principal of WF Pergande Consulting LLC and currently provides consulting engineering services with respect to marine industry, metallurgy, fluid dynamics and aqueous chemical solutions separation technologies. He retired in 2006 as the Global Leader for Desalination and Process Equipment for GE Infrastructure, Water and Process Technologies, which position he held since 2002. Mr. Pergande previously held the position of Vice President of Special Projects of Osmonics Inc. and Chief Executive Officer of the desalination subsidiary of Osmonics Inc., a publicly traded water treatment and purification company, until its acquisition by General Electric Co. Before joining Osmonics, Mr. Pergande was the Chief Executive Officer of Licon International Inc., a publicly traded manufacturer of liquid chemical separation, purification and processing equipment. Previously, Mr. Pergande was the President of Mechanical Equipment Company Inc. (MECO) for 14 years and held engineering, sales and executive managerial positions with AquaChem Inc., a subsidiary of Coca Cola Co,Co. at the time, both companies being manufacturers of seawater desalination equipment. He has a Bachelor’s Degreebachelor’s degree in Mechanical Engineering from Marquette University and Post Graduate Studies in Chemical Engineering, Metallurgy, Heat Transfer and Business Management from Marquette University and the University of Wisconsin. Mr. Pergande served three terms as a Director of the International Desalination Association, in which he held the positions of Treasurer and Secretary. He is a Member of Five Technical Societies related to the Business and has presented numerous Technical Papers at Society Meetings.

Mr. Pergande was selected to serve as a member of our Board of Directors because of his management and engineering experience in the desalination industry, and for his management, engineering, sales and marketing skills.

Leonard J. Sokolow, age 65, became67, has been a director of our Company onsince June 1, 2006. Since September 2023, Mr. Sokolow has served as Co-Chief Executive Officer of SKYX Platforms Corp. (Nasdaq: SKYX). He has served as an independent director and Chairman of the Audit Committee of SKYX Platforms from 2015 to February 2022 and continues to serve as a board member of that company and a member of its Corporate Development Committee. From 2015 to August 2023, Mr. Sokolow served as Chief Executive Officer and President of Newbridge Financial, Inc., a financial services holding company. From 2015 to July 2022

Mr. Sokolow served as Chairman of Newbridge Securities Corporation, Newbridge Financial, Inc.’s full-service broker-dealer. From August 2022 to August 2023 Mr. Sokolow served as CEO of Newbridge Securities Corporation and Newbridge Financial Services Group, Inc., Newbridge Financial, Inc.’s, full-service registered investment adviser. From November 1999 until

JanuaryJuly 2008, Mr. Sokolow was

the Chief Executive Officer

and President, and a member of the Board of Directors, of vFinance Inc., a publicly traded financial services company

which he

cofounded. Mr. Sokolow was theco-founded. He also served as its Chairman

of the Board of Directors and Chief Executive Officer of vFinance Inc. from January 2007 until July 2008, when it merged into National Holdings Corporation, a publicly traded financial services company. From July 2008 until July 2013, Mr. Sokolow was President of National Holdings Corporation, and from July 2008 until July 2014 he was Vice-Chairman of the Board of Directors of National Holdings Corporation. From July 2013 until December 2014, Mr. Sokolow was a consultant and partner at Caribou LLC, a strategic advisory services firm.

Since January 1, 2015, Mr. Sokolow has been Chief Executive Officer and President of Newbridge Financial, Inc. and Chairman of its principal subsidiary, Newbridge Securities Corporation. Mr. Sokolow was

a Founder, Chairman, and Chief Executive Officer of the Americas Growth Fund, Inc., a closed-end 1940 Act management investment company, from 1994 to 1998. From 1988 until 1993, Mr. Sokolow was an Executive Vice President and the General Counsel of Applica Inc., a publicly traded appliance marketing and distribution company. From 1982 until 1988, Mr. Sokolow practiced corporate, securities, and tax law and was one of the founding attorneys and a partner of an international boutique law firm. From 1980 until 1982, he worked as a Certified Public Accountant for Ernst & Young and KPMG Peat Marwick. Since

January 2016, Mr. Sokolow has served as a member of the Board of Directors of SQL Technologies Corp. (Nasdaq: SKYX) and Chairman of its Audit Committee and, since September 2016 through February 2022, Chairman of its Corporate Development Committee, since June 2020, he has served as a member of the Board of Directors of Vivos Therapeutics, Inc. (Nasdaq: VVOS), Chairman of its Audit Committee, and a member of its Nominations and Corporate Governance Committee, and since December 2021, Mr. Sokolow has served as a member of the Board of Directors of Agrify Corporation (Nasdaq: AGFY), where he currently serves as a member of the Audit Committee and the Compensation Committee.

Mr. Sokolow was selected to serve as a member of our Board of Directors because of his experience as a director and principal executive officer, his legal, accounting, auditing and consulting background, and his qualifications to serve as our “audit committee financial expert.”

Raymond Whittaker, age 68,70, has served as a director of our Company since 1988. Mr. Whittaker was the Managing Director of TransOcean Bank & Trust Ltd., a bank and trust company located in the Cayman Islands and a subsidiary of Johnson International Inc., a bank holding company located in Racine, Wisconsin from 1984 to December 2000. He is now the principal of his own company and management firm, FCM Ltd. On August 25, 2014, Mr. Whittaker was recognized as a Governance Fellow by the National Association of Corporate Directors (“NACD”) upon completion of NACD’s Governance Program and in recognition of an ongoing commitment to exemplary board leadership. Mr. Whittaker continues to participate in various NACD programs.Mr. Whittaker was selected to serve as a member of our Board of Directors because of his management, financial and banking experience.

Board Leadership Structure and Risk Oversight Mr. McTaggart currently serves as our principal executive officer, and Mr. Pergande, an independent director, currently serves as the Chairman of the Board of Directors. The Board of Directors has determined that having an independent director serve as Chairman of the Board of Directors is consistent with corporate governance best practices and is in the best interest of shareholders at this time. The structure ensures a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting goals, objectives and agendas to establish priorities and procedures for the work of the Board of Directors.

The Board of Directors is engaged in the oversight of risk through regular updates from Mr. McTaggart, in his role as our Chief Executive Officer, and other members of our management team, regarding those risks confronting us (including risks relating to regulatory compliance, information technology and cybersecurity, environmental and sustainability, climate change and public health), the actions and strategies necessary to mitigate those risks and the status and effectiveness of those actions and strategies. The updates are provided at regularly scheduled Board of Directors and committee meetings as well as through more frequent informal meetings that include the Chairman of the Board of Directors, our Board of Directors, our Chief Executive Officer, our Chief Financial Officer, our Chief Operating Officer, Vice President of Information Technology

and other members of our management team. The Board of Directors provides insight into the issues, based on the experience of its members, and provides constructive challenges to management’s assumptions and assertions.

Cybersecurity Risk

Our information technology (“IT”) and cybersecurity programs are crucial to maintaining secure operations, which enable us to deliver on our promise to customers and maintain stakeholder trust. Our Vice President of Information Technology (“VP IT”) is responsible for establishing, implementing, and executing our cybersecurity program and strategy. Our VP IT has more than 25 years of IT, IT audit, and cybersecurity experience, and is involved in assessing the latest developments in cybersecurity, including potential threats and innovative risk management techniques. All IT staff are obliged to include cybersecurity as part of their everyday considerations and tasks.

Our cybersecurity program is a critical component of our enterprise risk management process overseen by our Board of Directors, and we have integrated cybersecurity-related risks into our overall enterprise risk management framework. Additionally, cybersecurity-related risks are included in the risk universe that the risk management function evaluates to assess top risks to the enterprise on an annual basis.

Our IT department proactively identifies, manages, and mitigates cyber risk in a variety of ways, including but not limited to:

•

A formal enterprise-wide cybersecurity policy and related standards;

•

Cybersecurity training and employee phishing simulations;

•

Ongoing vulnerability assessment, identification, and remediation;

•

Cyber incident response, IT disaster recovery, and business continuity plans;

•

Identity and access management controls;

•

Automated patch management and security updates;

•

Network isolation of key operations environments; and

•

Email filtering with attachment inspection and targeted threat protection.

The standards set in our cybersecurity program include the implementation of controls that are aligned with industry guidelines and applicable regulations to identify threats, deter attacks, and protect our information security assets. These standards are guided, in part, by the relevant National Institute of Standards and Technology (NIST) and American Water Works Association (AWWA) frameworks and guidance. We use various tools, security measures and technologies to aid in seeking to protect our network perimeter and internal systems from unauthorized access, intrusion, or disruption. Assessments are conducted across our systems, networks, and data infrastructure to identify potential cybersecurity threats and vulnerabilities.

We have policies and procedures in place for selecting and managing our relationships with third-party service providers and other business partners, including monitoring compliance with our agreements and regulatory and legal requirements. We also actively engage with industry participants and related communities as part of our continuing efforts to evaluate and enhance the effectiveness of our information security policies and procedures. In addition, a monitoring and detection system has been implemented to help identify cybersecurity threats and incidents. Our cybersecurity program also focuses on providing training and awareness to our employees and contractors on cybersecurity best practices.

Our Board of Directors considers cybersecurity risk as part of its risk oversight function and has delegated to the Audit Committee oversight of cybersecurity and other IT risks. The Audit Committee oversees management’s implementation of our cybersecurity risk management program.

The Audit Committee oversees the management of our cybersecurity risk exposures and the steps management has taken to monitor and control such exposures. At each quarterly meeting, the Audit Committee receives an update from our VP IT and other members of management on relevant topics, including cybersecurity program maturity progress, new capabilities implemented, testing results, key cyber risk metrics (e.g., simulated

phishing testing and vulnerability management) and notable incidents or events should they occur. On an annual basis, our Board of Directors meets with our VP IT and our third-party cybersecurity consultant to review our cybersecurity strategy. In accordance with our cybersecurity incident response plan, our Board of Directors is promptly informed of potentially material cybersecurity incidents, including with respect to our third-party service providers.

Although we have experienced cybersecurity incidents from time to time that have not had a material adverse effect on our business, financial condition, or results of operations, there can be no assurance that a cyber-attack, security breach, or other cybersecurity incident will not have a material adverse effect on us in the future.

Our management team supervises efforts to prevent, detect, mitigate, and remediate cybersecurity risks and incidents through various means, which may include briefings from internal security personnel; threat intelligence and other information obtained from governmental, public or private sources, including external consultants engaged by us; and alerts and reports produced by security tools deployed in the IT environment.

Governance of the Company Pursuant to the Company’s

Amended and Restated Memorandum of Association, the

Company’s Amended and Restated Articles

of Association and Cayman Islands law, the Company’s business, property and affairs are managed under the direction of the Board of Directors. Members of the Board of Directors are kept informed of the Company’s business through discussions with the Chief Executive Officer and other senior officers, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees.

The Board of Directors has determined that the directors nominated for re-election

and all of the directors whose terms will continue after the Meeting (with the exception of Mr. McTaggart) are “independent” as such term is defined by the applicable listing standards of The NASDAQ Stock Market LLC (“NASDAQ”). The Board of Directors based this determination primarily on a review of the responses of the directors to questions regarding their employment, affiliations, family and other relationships.

The Company schedules meetings of the Board of Directors quarterly, in conjunction with its Annual General Meeting, and as necessary throughout the year. The Company expects that all directors will attend each meeting, absent a valid reason, such as a scheduling conflict. The Board of Directors held

sixseven meetings during

2021.2023.

Each director

(including specifically both of the Group I directors) attended at least 75% of the aggregate

number of (a) the total number of meetings of the Board of Directors held during

20212023 and

(b) the total number of

meetings held by all committees of the Board of Directors on which he or she served during

2021.2023, other than Linda Beidler-D’Aguilar who attended 69% of the aggregate number of such meetings.

The Board of Directors also has also adopted a Code of Business Conduct and Ethics that applies to all of the Company’sCompany directors, officers (including the principal executive officer, principal financial officer and principal accounting officer) and employees. Our Code of Business Conduct and Ethics is posted on the “Investors — Governance” section of the Company’s website: http://www.cwco.com. If, in the future, the Board of Directors amends the Code of Business Conduct and Ethics or grants a waiver to our principal executive officer, principal financial officer or principal accounting officer with respect to the Code of Business Conduct and Ethics, the Company will post the amendment or a description of the waiver on the “Investors — Governance” section of the Company’s website.

Insider Trading and Hedging Policy The Board of Directors has adopted an Insider Trading and Disclosure of Non-Public Information Policy, which applies to all of the Company’s directors, officers, employees, agents and representatives and is reasonably designed to promote compliance with insider trading laws, rules and regulations, and any applicable NASDAQ listing standards. The insider trading policy expressly prohibits directors, officers, employees, agents and representatives of the Company from purchasing or selling the Company’s securities while in possession of material, non-public information, or otherwise using such information for their personal benefit. It further

prohibits directors, officers, employees, agents and representatives from engaging in hedging transactions, such as purchasing or writing derivative securities including puts and calls and entering into short sales or short positions with respect to the Company’s stock.

Our directors, officer, employees, agents and representatives are permitted to enter into trading plans that are intended to comply with the requirements of Rule 10b5-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), so that they can prudently diversify their asset portfolios and exercise their stock options before expiration.

Our Insider Trading and Disclosure of Non-Public Information Policy is posted on the “Investors — Governance” section of the Company’s website: http://www.cwco.com and has been filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 that was filed with the SEC on March 27, 2024.

Committees of the Board of Directors The Board of Directors has four committees: (1) the Compensation Committee; (2) the Audit Committee; (3) the Nominations and Corporate Governance Committee and (4) the recently formed Environmental and Social and Governance Committee. The Board of Directors has adopted a written charter for each of these committees, other than the Environmental, Social and Governance.committees. The charters for the Compensation Committee, the Audit Committee and the Nominations and Corporate Governance are posted on the “Investors — Governance” section of the Company’s website: http://www.cwco.com. The Company has drafted a charter for the Environmental, Social and Governance Committee, and such charter is expected to be reviewed and approved at meeting of the Board of Directors later this year. Once adopted, such charter also will be posted on the “Investors — Governance” section of the Company’s website. | Director | | Compensation

Committee | Compensation

Committee | Audit

Committee | | Audit

Committee | | | Nominations

and Corporate

Governance

Committee | | | Environmental and

Social and Governance

Committee | |

| Linda Beidler-D’Aguilar | | | | | | X | | | X | | | X | |

| Brian E. Butler | | | X | | | | | | C | | | X | |

| Carson K. Ebanks | | | X | | | | | | X | | |

Richard L. Finlay | | C | | X | | | | X |

| Clarence B. Flowers, Jr. | | | X | | | | | | | | | X | |

| Frederick W. McTaggart | | | | | | | | | | | | C | |

| Wilmer F. Pergande | | | | | | X | | | X | | | | |

| Leonard J. Sokolow | | | | | | C | | | X | | | | |

| Raymond Whittaker | | | C | | | X | | X | | | | | | | |

________________

The Compensation Committee consists of Messrs. Butler, Ebanks,

Finlay, Flowers and Whittaker. The Compensation Committee held three meetings during

2021.2023.

The Compensation Committee is responsible for developing, reviewing and approving the executive compensation program for the Company and its subsidiaries; assessing executive performance; establishing and approving annual incentive compensation plans; approving certain employment agreements; and reviewing and consulting with the Company’s management regarding the executive compensation disclosure (and previously the Compensation Discussion and Analysis) that is included in the Company’s proxy statement for each annual meeting. The Board of Directors has adopted a written charter for the Compensation Committee. The Board of Directors has determined that all members of the Compensation Committee are “independent directors,” as such term is defined under the applicable rules of NASDAQ.

The Audit Committee consists of

Ms. Beidler-D’Aguilar and Messrs.

Finlay, Pergande, Sokolow and Whittaker. The Audit Committee held four meetings during

2021.2023.

The Audit Committee assists the Board of Directors in monitoring the financial reporting process, the internal control structure and management’s testing of such control structure, the independent registered public accountants and the approval of outside consulting services pertaining to the financial and internal control functions of the Company. Its primary duties are to serve as an independent and objective party to monitor the Company’s financial process and internal control system, to select and determine the remuneration of the Company’s independent accountants, to review and appraise the audit effort of the independent accountants and to provide an open avenue of communications among the independent accountants, financial consultants, financial and senior management and the Board of Directors. The Board of Directors has adopted a written charter for the Audit Committee, and the Audit Committee reviews and reassesses the adequacy of its charter every three years, unless changes in circumstances or regulatory requirements necessitate assessment on a more frequent basis. During the year, the Board of Directors examined the composition of the Audit Committee in light of NASDAQ’s corporate governance rules and the regulations promulgated by the United States Securities and Exchange Commission (the “SEC”) applicable to audit committees. Based upon this examination, the Board of Directors has determined that all members of the Audit Committee are “independent directors” within the meaning of applicable rules and regulations of NASDAQ and the SEC. The Board of Directors has also determined that Mr. Sokolow qualifies as an “audit committee financial expert” as defined under applicable rules and regulations of NASDAQ and the SEC.

Nominations and Corporate Governance Committee

The Nominations and Corporate Governance Committee consists of

Ms. Beidler-D’Aguilar and Messrs. Butler, Ebanks, Pergande and

Sokolow and Ms. Beidler-D’Aguilar.Sokolow. The Nominations and Corporate Governance Committee held two meetings during

2021.2023.

The Nominations and Corporate Governance Committee makes recommendations to the Board of Directors regarding the size and composition of the Board of Directors and the qualifications of the members of the Board of Directors, establishes procedures for the nomination process, recommends candidates for election to the Board of Directors and nominates officers for election by the Board of Directors. The Board of Directors has determined that all members of the Nominations and Corporate Governance Committee are “independent directors,” as such term is defined under applicable rules of NASDAQ. The criteria for the Nominations and Corporate Governance Committee to recommend nominees for membership on the Board of Directors is contained in the “Consolidated Water Co. Ltd. Corporate Governance Guidelines,” whereby candidates should possess certain minimum qualifications for Board membership, including strong personal values and discipline, high ethical standards, a commitment to full participation on the Board of Directors and its committees and relevant career experience, and whereby diversity of thought, experience, gender and ethnicity shall be considered a priority in any such recommendations.

To recommend a prospective nominee for the Nominations and Corporate Governance Committee’s consideration, a shareholder may submit the candidate’s name and qualifications in writing to the Secretary of the Company, Consolidated Water Co. Ltd., Regatta Office Park, Windward Three, 4th4th Floor, West Bay Road, P.O. Box 1114, Grand Cayman, KY1-1102, Cayman Islands.

Environmental and Social and Governance Committee The Environmental

and Social

and Governance Committee consists of

Ms. Beidler-D’Aguilar and Messrs. Butler,

FinlayFlowers and

McTaggart and Ms. Beidler-D’Aguilar.McTaggart. The Environmental

and Social

and Governance Committee

was formed in 2022, and therefore held

notwo meetings during

2021.2023.

The Environmental

and Social

and Governance Committee provides oversight of our policies relating to Environmental

and Social

and Governance (“ESG”) topics and operational controls of environmental, health and safety, and social risks, and is committed to supporting the Company’s efforts to operate as a sound corporate citizen. We believe that an integrated approach to business strategy, corporate governance and corporate citizenship creates long-term value. The following summary highlights certain of our policies and initiatives in these areas.

We believe that sound corporate citizenship and attention to governance and environmental principles are essential to our success and that of our affiliates.

We are committed to operating with integrity, contributing to the local communities surrounding our global offices, promoting diversity and inclusion, developing our employees and being thoughtful stewards of natural resources. We are also focused on the security of our data and safeguarding our supplier’s and clients’ privacy.

Environmental and Social and Governance (ESG) Highlights

| | Healthy and Safe Work Environment | | | ·•

Commitment to comply with all applicable health and safety laws, regulations and other requirements to which we subscribe. Integration of health and safety considerations into business decisions to ensure health and safety of our employees and the community. Equal employment opportunity hiring practices, policies and management of employees. Anti-harassment policy that prohibits hostility or aversion towards individuals in protected categories, and prohibits sexual harassment in any form, and details how to report and respond to harassment issues and strictly prohibits retaliation against any employee for reporting harassment. Since January 1, 2020,2022, we have not been a party to any suits, investigations, inquiries or other proceedings relating to occupational safety and health, nor have any such proceedings been overtly threatened. During 20202022 and 2021,2023, we had no work-related fatalities or occupational diseases and one and four workplace injuries, respectively. | |

| | Diversity and Inclusion | | | ·•

Committed to fostering and promoting an inclusive and globally diverse work environment. Formal policy that forbids discrimination based on protected classifications. One director identifying as female and three directors identifying as “two or more races or ethnicities” under The NasdaqNASDAQ Stock Market’s diversity rules, representing 50% of the non-executive members of the Board. | |

| | Prevention of Human Trafficking and Forced and Child Labor | | | ·•

Formal policy that forbids use of forced, debt bonded, indentured labor, involuntary prison labor, slavery or human trafficking in our business or supply chain. Prohibition on employment of anyone under the age of 16 in any position, and workers under the age of 18 for hazardous work, overtime, or night shift work. | |

| | Wage and Hour Standards | | | ·•

Working hours not to exceed the greater of 60 hours per week or the maximum set by local law. Prohibition on working longer than six consecutive days without at least one day off. Commitment to comply with applicable wage laws, including those related to minimum wages, overtime hours, and legally mandated benefits. | |

| | Freedom of Association and Collective Bargaining | | | ·•

Employees have the right to freely associate or not associate with third party organizations such as labor organizations. Employees also have the right to bargain or not bargain collectively in accordance with local laws. | |

| | Privacy and Data Security | | | ·•

Maintaining privacy policies, management oversight, and accountability structures to protect privacy and personal data. | |

| | Business Conduct and Ethics Codes | | | ·•

A strong corporate culture that promotes the highest standards of ethics and compliance for our business; the majority of our directors have an extensive background and experience in risk management. Code of Business Conduct and Ethics sets forth principles to guide employee and director conductconduct. | |

| Business Continuity | | | ·•

As a provider of water, which is essential to life, we have business continuity policies to ensure the safety of our personnel, facilities and critical business functions in case of natural disasters and other emergencies. | |

| | Environment | | | ·•

Formal policy to identify principle environmental aspects of our operations, and seek to mitigate waste, emissions, energy and water use and other impacts wherever feasible. Commitment to environmental protection and conservation of natural resources through innovative processes and continuous improvement methodologies. Commitment to continue to invest in energy conservation, work to reduce our environmental footprint, and adhere to environmental laws, regulations, policies and goals. | |

| | Governance | | | ·•

Strong focus on corporate governance since inception, striving for best practices in corporate governance. | |

| | Stakeholder Involvement | | | ·•

Commitment to receive feedback from such stakeholders to help improve ESG-related policies, the implementation thereof and our performance thereunder. | |

| | Anti-Bribery and Corruption Policies | | | ·•

Policies prohibiting improper or unauthorized expenditures (including commercial and public bribery) and other improper payment schemes. Mechanism for confidential reporting of any suspected violations. | |

As reflected above, we have adopted a number of practices and policies that highlight our commitment to

socialenvironmental and

environmentalsocial responsibility and that seek to promote sustainability and health and well-being in the operation of our business. These practices are designed to position us as a supplier of choice to our customers, an employer of choice to our existing and prospective employees, and a neighbor of choice in our communities. We are committed to the ethical and environmentally responsible operation of our business and have undertaken a number of initiatives to reduce our environmental impact and to ensure a healthy and safe workplace.

As the highlights above demonstrate, we have and enforce a number of ESG-related policies in our workplace, and we expect our suppliers and business partners to adhere to these requirements and to promote these values. WhileAs climate-related risks evolve, so does the need to align sustainability and the assessment of risk. Our goal is to continuously enhance our understanding of enterprise-wide risk and uncertainty with comprehensive evaluation of current risks, scenario planning, and quantitative analysis. These tools strengthen our ability to successfully integrate sustainability into our strategic decision-making processes. By doing so, we have always been committedare better able to assess operational, environmental, and social uncertainties and weigh their potential implications for our strategic priorities. Our commitment to operating our business in a manner that is environmentally responsible and protective of the health and safety of our employees, is formalized in 2021 we adopted the following policiespolicies:

•

Human Rights Policy — We maintain a Human Rights Policy that seeks to formalizepromote the operation of our commitment: | · | Human Rights Policy — We maintain a Human Rights Policy that seeks to promote the operation of our business in an ethical and socially responsible way and that reflects our commitment to the corporate social responsibility principles reflected in the United Nations (“UN”) Global Compact, the Universal Declaration of Human Rights, the UN Guiding Principles on Business and Human Rights, core International Labour Organization Conventions, the Organization for Economic Co-operation and Development Guidelines for Multinational Enterprises, and the laws of the countries in which we operate. |

| · | Environmental, Health and Safety Policy — We maintain an Environmental, Health and Safety Policy to guide the conduct of our business in a safe and environmentally sustainable and responsible manner that promotes the health of our employees, customers, community and the environment and that meets global environmental, health and safety requirements. |

business in an ethical and socially responsible way and that reflects our commitment to the corporate social responsibility principles reflected in the United Nations (“UN”) Global Compact, the Universal Declaration of Human Rights, the UN Guiding Principles on Business and Human Rights, core International Labour Organization Conventions, the Organization for Economic Co-operation and Development Guidelines for Multinational Enterprises, and the laws of the countries in which we operate.

•

Environmental, Health and Safety Policy — We maintain an Environmental, Health and Safety Policy to guide the conduct of our business in a safe and environmentally sustainable and responsible manner that promotes the health of our employees, customers, community and the environment and that meets global environmental, health and safety requirements.

Copies of these policies and related information can be found on the “Investors — Governance” section of the Company’s website.

Incentive Compensation Recoupment Policy In 2023, we adopted an Incentive Compensation Recoupment Policy in compliance with NASDAQ rules. Under our Incentive Compensation Recoupment Policy, if we are required to prepare an accounting restatement due to material noncompliance with the financial reporting requirements under United States securities laws, the Company will be entitled to recover (and will seek to recover), from our executive officers, any excess incentive-based compensation received by our executive officers during the three-year period prior to the date on which we are required to prepare the restatement. This policy applies to both equity-based and cash compensation awards. The “excess compensation” is the difference between the actual amount that was paid and the amount that would have been paid if the financial statements were prepared properly in the first instance. To ensure that we can enforce the Incentive Compensation Recoupment Policy, we require each executive officer subject to the policy to execute an acknowledgement stating that the executive has received and reviewed the policy and agrees that he or she is fully bound by the policy.

Board of Directors Diversity Matrix| Board Diversity Matrix (As of March 24, 2022) | |

| Total Number of Directors | | 9 |

| | Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 1 | 8 | - | - |

| Part II: Demographic Background | |

| African American or Black | - | - | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | - | - | - | - |

| Hispanic or Latinx | - | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White | 1 | 5 | - | - |

| Two or More Races or Ethnicities | - | 3 | - | - |

| LGBTQ+ | | - |

| Did Not Disclose Demographic Background | - |

| Board Diversity Matrix (As of March 28, 2024) | |

Total Number of Directors | | | 8 | |

| | | | Female | | | Male | | | Non-Binary | | | Did Not

Disclose

Gender | |

| Part I: Gender Identity | |

| Directors | | | 1 | | | 7 | | | — | | | — | |

| Part II: Demographic Background | |

| African American or Black | | | — | | | — | | | — | | | — | |

| Alaskan Native or Native American | | | — | | | — | | | — | | | — | |

| Asian | | | — | | | — | | | — | | | — | |

| Hispanic or Latinx | | | — | | | — | | | — | | | — | |

| Native Hawaiian or Pacific Islander | | | — | | | — | | | — | | | — | |

| White | | | 1 | | | 4 | | | — | | | — | |

| Two or More Races or Ethnicities | | | — | | | 3 | | | — | | | — | |

| LGBTQ+ | | | — | |

| Did Not Disclose Demographic Background | | | — | |

Shareholder Communication with Directors Shareholders of the Company who want to communicate with the Board of Directors or any individual director may write to:

Consolidated Water Co. Ltd.Regatta Office Park, Windward Three, 4th Floor, West Bay RoadP.O. Box 1114Grand Cayman, KY1-1102Cayman IslandsAttn: Secretary of the Company The letter should include a statement indicating that the sender is a shareholder of the Company. The Secretary will review all shareholder letters with the Board of Directors and depending on the subject matter will:

| · | Regularly forward any letter that deals with the function of the Board of Directors or any committees of the Board of Directors (or any matter otherwise appropriate for Board attention) to the director or directors to whom it is addressed; |

| · | Attempt to handle the inquiry directly if it relates to routine or ministerial matters, including requests for information about the Company and stock-related matters; |

| · | Based upon the advice of appropriate legal counsel, not forward the letter if it relates to an improper or irrelevant topic; or |

| · | At each meeting of the Board of Directors, present a summary of all letters received since the last meeting that were not forwarded to the Board of Directors and make those letters available to the Board of Directors upon request. |

Regularly forward any letter that deals with the function of the Board of Directors or any committees of the Board of Directors (or any matter otherwise appropriate for Board attention) to the director or directors to whom it is addressed;

•

Attempt to handle the inquiry directly if it relates to routine or ministerial matters, including requests for information about the Company and stock-related matters;

•

Based upon the advice of appropriate legal counsel, not forward the letter if it relates to an improper or irrelevant topic; or

•

At each meeting of the Board of Directors, present a summary of all letters received since the last meeting that were not forwarded to the Board of Directors and make those letters available to the Board of Directors upon request.

The Audit Committee submits the following report for

2021:2023:

The Committee has reviewed and discussed with both management and the independent registered public accountants (the “independent auditors”) the audited consolidated financial statements of the Company as of and for the year ended December 31,

2021.2023. The Committee’s review included discussion with the independent auditors of the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board.

The Committee has received the written disclosures and the letter from the independent auditors required by the Public Company Accounting Oversight Board Rule 3526, Communication with Audit Committees Concerning Independence, and has discussed with the independent auditors matters relating to their independence. Based on the reviews and discussions referred to above, the Committee recommended to the Board of Directors that the audited consolidated financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31,

2021,2023, for filing with the SEC.

| | Submitted by the Members of the 20212023 Audit Committee | |

| | Richard L. FinlayLinda Beidler-D’Aguilar

Wilmer F. Pergande

Leonard J. Sokolow

Raymond Whittaker |

INTRODUCTION TO PROPOSALS 2 – 5:

Special Resolutions

In connection with the Company’s corporate housekeeping, review of the Company’s governing documents and desire to maintain good corporate governance practices, the Board, together with its committees and the Company’s management, undertook a review of the Company’s Memorandum of Association (the “Memorandum”) and the Articles and the Company’s corporate governance practices. As a result of this review, the Board approved several amendments to the Memorandum and the Articles, subject to shareholder approval, and has determined to submit Special Resolutions to the shareholders in connection therewith. A summary of the Special Resolutions follows.

Summary of Special Resolutions

The Board approved amendments, subject to shareholder approval by Special Resolution, to amend the Memorandum by:

| · | Updating references to applicable law, specifically replacing references to “The Companies Law (1998 Revision)” with references to “The Companies Act (Revised);” and |

| · | adding the postal code for the Company’s registered office. |

Proposal 3

The Board approved amendments, subject to shareholder approval by Special Resolution, to amend the Articles by:

| · | adding the definition of “Designated Stock Exchange” in connection with the provisions concerning the manner in which shares may be transferred; |

| · | updating the definition of “in writing” and “written” to account for advances in technology; |

| · | updating references to applicable laws, which have replaced the previously referenced laws; |

| · | changing the manner in, and form by, which shares may be transferred, including in the forms prescribed by the Designated Stock Exchange and to account for advances in technology; |

| · | clarifying the circumstances around which the Company has a lien on the shares of a shareholder; |

| · | changing the manner in which shareholders’ votes will be cast and recorded; and |

| · | eliminating the classified board structure and three-year terms of office for directors, and replacing such structure and terms with a non-classified board structure and one-year terms. |

Proposal 4

In connection with the proposed amendments to the Articles to eliminate the classified board structure and three-year terms of office for directors, and replace such structure and terms with a non-classified board structure and one-year terms, the Board determined, subject to shareholder approval by Special Resolution, that directors elected as Group I, Group II or Group III directors of the Company shall be re-designated as directors of the Company.

13

Proposal 5

The Board approved, subject to shareholder approval by Special Resolution, an Amended and Restated Memorandum of Association and an Amended and Restated Articles of Association of the Company incorporating any and all amendments approved by Special Resolution in Proposals 2 and 3.

Marked versions of the Amended and Restated Memorandum of Association and Amended and Restated Articles of Association, including the full text of every amendment proposed to be made to the existing Memorandum and existing Articles, are attached hereto as Appendix A and Appendix B, respectively. Words and phrases that are marked through with a single line represent deletions, and words and phrases that appear in bold text and are underlined represent additions.

The general overview in this Introduction to Proposals 2 – 5 is followed by a more detailed discussion of each amendment separately in the sections of this Proxy Statement that discuss such Proposals. Although the following discussion highlights the material changes, it does not highlight every change. Therefore, shareholders are urged to read carefully the following discussion as well as the marked versions of the Amended and Restated Memorandum of Association and Amended and Restated Articles of Association attached hereto as Appendix A and Appendix B, respectively, before voting on the Proposals.

Vote Required

The Articles require the affirmative vote of shareholders holding at least 75% of the Shares cast at the Annual General Meeting to approve each Special Resolution submitted under Proposals 2 – 5.

As more fully discussed below, the Board of Directors believes that each of the Special Resolutions is advisable and in the best interests of the Company and its shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” EACH OF THE PROPOSED SPECIAL RESOLUTIONS IN PROPOSALS 2 – 5.

PROPOSAL 2Amendments to Memorandum

Preliminary Statement